Impressive Tips About How To Apply For A Secured Credit Card

Upon approval your credit line will be equal to your deposit.

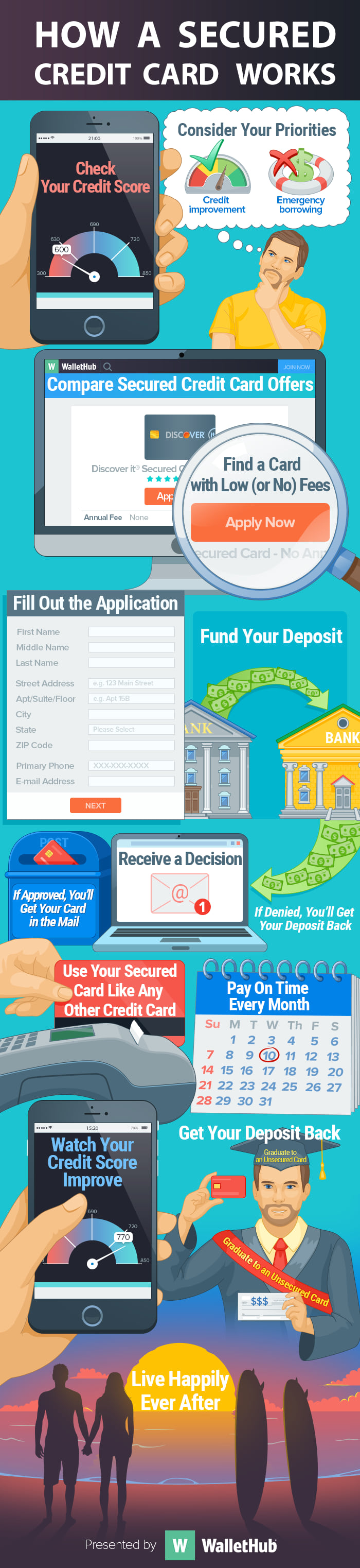

How to apply for a secured credit card. The lender may request that you secure the credit line partially or fully with a deposit. Find secured credit cards for balance transfer & small business. A secured credit card is backed by collateral, so they are available to borrowers with low scores.

Visit the discover it secured web page and, after reading the offer’s details, click on the orange button “apply. To get a secured credit card, you need to provide a cash deposit—usually $200. Ad get a prepaid secured credit card with direct deposit from your checking account.

Unlike a debit card, it helps build your credit history with monthly. Reasons you should get a secured credit card. Ad real credit card with no annual fee plus earn cashback on purchases.

The deposit is usually equal to the credit limit on the card. Ad get access to the credit you need with a refundable secured card deposit—apply today. A secured credit card looks and operates like a regular credit card.

Here’s a simple 3 step guide to make it easier for your get approved for it today: Fuel your life with credit lines starting at $200 and up to 2% cash back. Ad get access to the credit you need with a refundable secured card deposit—apply today.

Open your account with a security deposit (minimum $1,000). When the card is issued, the annual fee is waived on the first year. Ad the perfect credit card to help those with no credit or bad credit, with no credit check.

/secured-vs-unsecured-credit-card-final-89a160834c364a43a0913e67176e0215-f0faefaa72694b7e9ce3e5efd853a502.png)

/secured-vs-unsecured-credit-card-final-89a160834c364a43a0913e67176e0215-f0faefaa72694b7e9ce3e5efd853a502.png)